Oraclum Capital: the hedge fund

NOTE: This is not financial advice. We are allowed to “generally solicit and advertise” the existence of the fund under Rule 506(c) of Regulation D of the Securities Act of 1933 in the United States, but we are only allowed to respond to accredited investors. If you are not an accredited investor, please refrain from contacting us over this matter.

Why a hedge fund?

What motivated us to go and open a hedge fund? This was a long personal goal of mine, however, I wanted a fund using a quarterly macro strategy, the same way I trade for my personal account. Closer to wealth management rather than hedge fund, really.

But turning BASON into a tradeable strategy was actually inspired by many of our readers. Dozens of you, impressed by our performance, contacted us suggesting we should turn the BASON into some sort of fund, an ETF even. We took that advice seriously. During the summer we made a brief pitch and got in touch with many people from the finance industry and investor community, mostly in the US and London, to see if that idea would even make any sense. A weekly prediction method that consistently beats the markets? Fat chance!

However, much to our excitement, the feedback was excellent. We got really useful suggestions on how to organize the whole thing, how to backtest a bunch of alternative strategies, how to set up the fund structure, automate our trading, etc. A few of these calls ended up as our investors. Kudos to them for taking the plunge!

The next step were a few cap raise events, to see if there is any real interest among investors. Again, to our excitement, there was. The stage was set, regulatory requirements fulfilled, the fund is registered in the US, and will be live trading by the end of January 2023. We have liftoff!

How come our returns are so large?

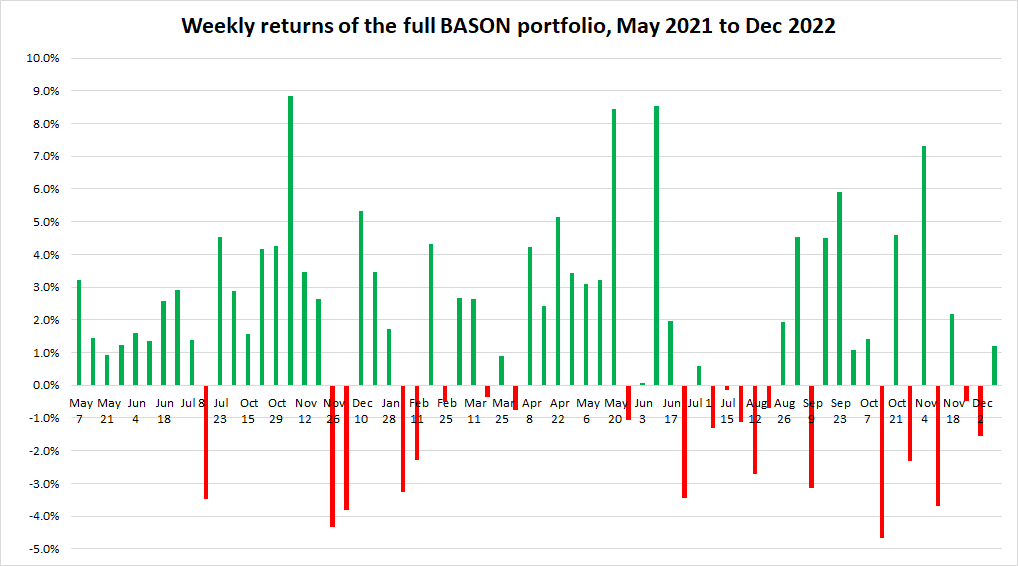

Two reasons. First, positive skew. We apply a weekly trading strategy that limits losses each week (max of 5% of the total portfolio) and lets the profits run. The bulk of our annual returns comes from a few great weeks, where our weekly returns are over 8% (this means that our options positions delivered 100% or 200% winners).

The figure shows the weekly returns for the full portfolio from the beginning. The more good weeks we get, the better the performance.

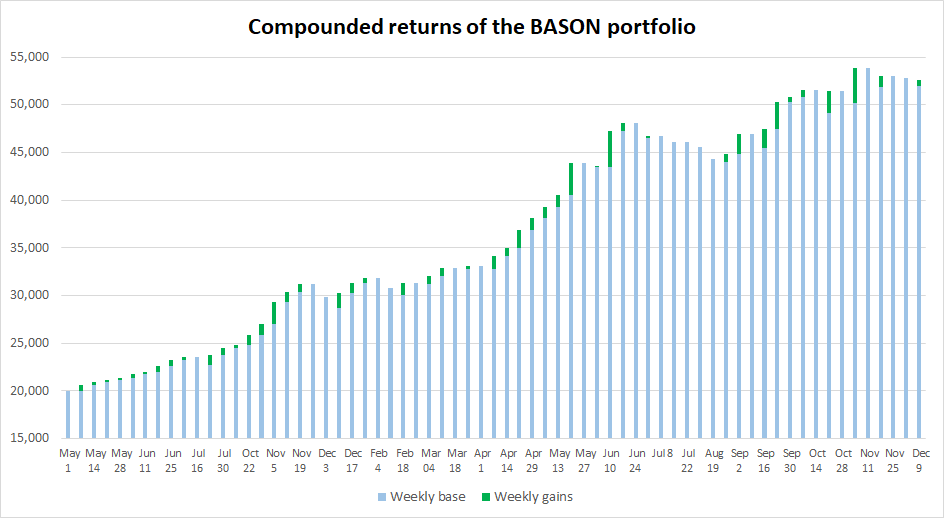

The second reason is the weekly compounding effect. Each week we take profits (or incur losses) and reinvest them the following week. No unrealized profits here.

It is important to note that past performance is obviously NOT indicative of future returns. Whatever we made thus far was made with small weekly investments (a few thousand dollars), so now the key is to see how this will perform with a few million.

Structure and allocation

The hedge fund will follow the same allocation as what we’ve presented to you during our Q4 this year. In short::

Half of the portfolio will follow our weekly BASON predictions, where 10% gets allocated to options with 2 days expiry which we still keep buying on Wednesdays and closing on Fridays, while 40% is allocated to long/short positions in our main indices of interest (SPY for S&P500, UVXY for VIX, while the DIA for the Dow will most likely be replaced with QQQ for the NASDAQ due to the lack of liquidity of DIA options). This half of the portfolio is highly liquid, turned into cash each Friday (while taking profit or incurring a loss).

The second half of the portfolio is to balance out the risk and ensure beta neutrality of the portfolio. 40% will be designed for macro positioning (macro-based long/short positions in SPY and QQQ, adjusted monthly or quarterly, based on following the macro strategy - read more here), and the other 10% is in highly liquid instruments: 2Y US Treasuries and cash - both providing a stable, yet low return.

The fund will charge 1.5% entry fee, a 1.5% management fee each year, 0% exit fee, and 25% performance fee subject to an 8% hurdle (meaning that no performance fee is charged below 8%, and the 25% is only applied to anything above 8%).

Have any more questions? Reach out and let us know what you think about this and if you have any valuable feedback.

And if you’re an accredited investor, we invite you to express initial interest on this link, obviously non-binding and only informative, so that we can get in touch (see the description in italic in the beginning of the text).